The Biden Administration’s $2 trillion infrastructure plan harbors a significant investment in US chip production, aiming to boost national security by lessening dependence on foreign countries. The US only generated 12% of the world’s chips last year, creating dependency on international manufacturers, mainly in Asia.

For instance, Taiwan contributes to 22% of the global chip production and over 90% of the most sophisticated chips. The vulnerability of the chip supply chain was highlighted recently, particularly after President Trump’s executive mandate banned using telecommunication equipment from foreign enterprises considered a national security threat. This order significantly hit Chinese firms like Huawei.

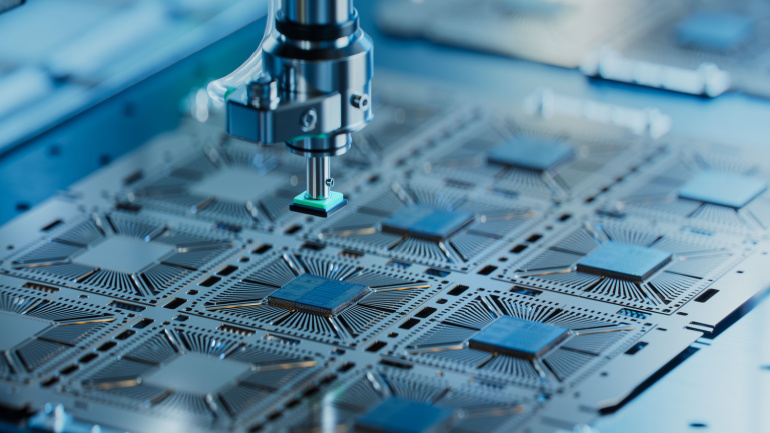

To counter this heavy reliance on international manufacturing, the US is hoping that the CHIP act’s investments will vitalize the domestic chip production. Intel, a notable beneficiary of the CHIPS Act, highlighted its progress updates for its new manufacturing units. In 2021, Intel declared over $43.5 billion in manufacturing investments across the US, including Arizona, New Mexico, and Ohio.

In Arizona, Intel plans to grow from two to four semiconductor plants with an approximate cost of around $20 billion each. In New Mexico, the company will spend $3.5 billion in upgrading equipment for the existing plant. In Oregon, Intel is contemplating a ‘multi-billion-dollar expansion and modernisation’. Intel also pledged to invest $100 million into semiconductor education and research expansion and employee training across America.

On the flip side, for other companies, the journey isn’t as straightforward. No money has yet been awarded since the CHIPS Act was signed last year. The Commerce Department reportedly received over 460 expressions of interest to manufacture semiconductors in the US, and it admitted that each application requires an in-depth evaluation.

“Later this year we will start to give out the money,” said Secretary of Commerce Gina Raimondo, adding, “We’re pushing the team to go fast, but even more important, to get it right.”

While potential federal funding has triggered substantial private sector investment, many of these investments hinge on the release of the federal funding. Firms like Integra Technologies are planning to build a 1 million-square-foot facility in the Wichita, Kansas area, only if they can receive the federal aid.

The Department of Commerce has appointed 140 members to review funding applications. They stated that tough choices were imminent about how to distribute their capital and not all applicants would be satisfied.