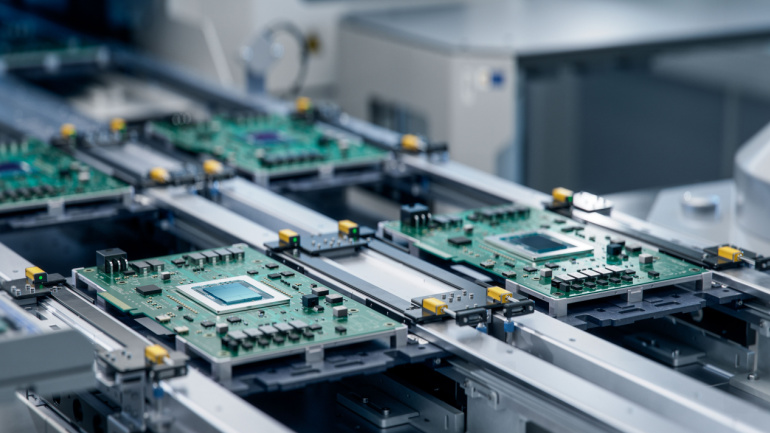

The well-known research firm IDC foresees a promising upswing for the semiconductor industry next year, with expected rejuvenation being propelled by advancements in AI and a recovery of stock levels. Upgraded predictions for 2023 anticipate a global chip revenue of $526.5 billion. Although this is still a 12% decrease from last year, it signifies progress from the $519 billion projected earlier in September.

IDC didn’t stop with this positive reaffirmation. The resolute firm has also taken a bold step, announcing the end of the market downturn, transitioning its outlook from ‘trough’ to ‘sustainable growth’.

Further optimism can be found as IDC raises its revenue forecast for 2024. Prospects for year-on-year growth are now at 20.2% to $633 billion, a substantial leap from the previously forecasted $626 billion.

The root cause of this renewed optimism can be traced back to the diminishing inventory correction in the PC and smartphone markets. “While inventory levels remain elevated with suppliers, visibility has clearly improved in the channel and with OEMs in key market segments,” noted Rudy Torrijos, research manager for worldwide semiconductor supply chain technology intelligence at IDC.

The relentless surge of AI technology is also expected to spur demand for semiconductors. Both end user devices such as PCs & smartphones and AI servers & supercomputers hosting large language models (LLMs) are anticipated to be key drivers. “

Accelerating demand for AI servers and AI-enabled end point devices will drive more semiconductor content in 2024-2026, fuelling a new upgrade cycle across enterprises,” stated Mario Morales, group vice president, semiconductors and enabling technologies at IDC.

These findings seem to echo throughout the telecoms and tech arenas. For instance, Qualcomm CEO Cristiano Renno Amon remarked on their Q4 results call, “On-device Gen AI is evolving in parallel with Gen AI in the cloud, enabling entirely new use cases.”

In addition, market activity has surged on the cloud front as well. Microsoft recently introduced its first custom chips, including the Azure Maia AI Accelerator for gen AI tasks and the Azure Cobalt CPU, based on an Arm design, tailored for general computing on the Microsoft Cloud.

Such optimistic undertones are also reinforced by the increased demand for AI services among enterprises. Various partnerships, such as the recent collaboration between Amdocs and Nvidia, are being formed to address this rising need.

While the celebrations might be premature, the mounting evidence seems to indicate that the worst phase for the chip industry may have passed. Suffice to say, current events and forecasts present a hopeful narrative for a sector that has been beleaguered by numerous challenges.